Saturday September 30th highlights for Your Safe Money Show. This week Todd will look at the possible government shutdown and how it can affect your money. If you will need a passport there are delays you need to know about. And are you committing insurance fraud without realizing it? Listen at 8 a.m. at Nice 95.5FM KBEK. They stream live at kbek.com. Hear recent shows at yoursafemoneyshow.com.

Thursday, September 28, 2023

Tuesday, September 26, 2023

Retirement ranking

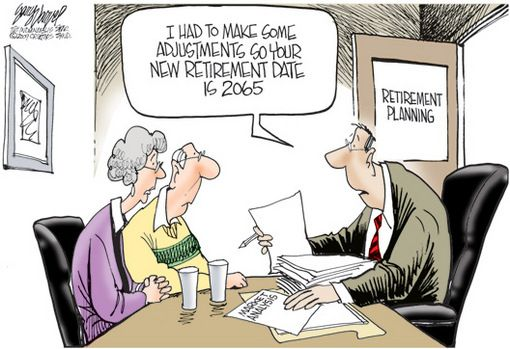

I always keep my eyes out for information on all things “retirement” related and this week there was a global ranking of the top countries for retirement and the U.S. slipped two places in this year’s analysis from No. 18 in 2022 to No. 20. The top nation for retirement security is Norway, followed by Switzerland and Iceland. America’s high inflation and rising government indebtedness, lowered life expectancy, due to COVID and rising overdose and gun-related deaths are criteria for the ranking around 20 in regard to retirement security. At the same time, more Americans are expressing increased anxiety about retirement, with 47% saying it would "take a miracle" for them to achieve retirement security, up 6 percentage points from 2021. Inflation has been the big driver of uncertainty even as inflation has dropped some in the last 6 months or so. The global index of retirement security ranks nations based on four areas: health, quality of life, finances in retirement and material well-being. Norway, which the firm called a "standout performer," ranked first in health and fourth in quality of life. Life expectancy rose in Norway, in contrast to the U.S.' decline. The U.S. ranked 25th for health in the current survey, down from 17th in the prior year. A director of the analysis says, if you look at the top performers, they tend to be smaller countries. It's easier for a smaller country to get consensus on a lot of the issues, say, like health care, compared with larger countries like the U.S. yoursafemoneyshow.com.

Monday, September 25, 2023

Thursday, September 21, 2023

Content for September 23rd Your Safe Money Show

Coming up on Your Safe Money Show Saturday September 23rd, Todd will debunk popular myths on how bureaus tally your credit score. He’ll have financial considerations if you’re raising your grandchildren. And have you heard of Google Flights and can it save you money? Listen at 8 a.m. at Nice 95.5FM KBEK. They stream live at kbek.com. Hear recent shows at yoursafemoneyshow.com on the home page

Wednesday, September 20, 2023

Tuesday, September 19, 2023

Your Money Survey findings

A new CNBC Your Money Survey conducted by SurveyMonkey found 74% of Americans are feeling financially stressed, up from 70% in an April survey. About 37% of respondents indicated that they are “very stressed” about their personal finances, compared to only 30% in April. The top stressors remained the same as in April: inflation, rising interest rates and a lack of savings. Some of the findings, 4 in 10 workers are NOT contributing to a 401(k) or employer sponsored plan. The good news is that means 6 out of 10 ARE contributing and here’s how they’re funding their 401(k) plan. 46% are contributing as much as they can afford. 24% are putting away as much as their employer will match. 11% are saving up to this year’s employee contribution limit. 8% just save the automatic default amount set by their plan. Here’s facts about 401(k)’s: In 2023, workers younger than 50 years old can save up to $22,500 for retirement in 401(k) plans, and savers who are age 50 and older can put away an extra $7,500 in “catch-up” contributions. The average company match in a 401(k) plan was 4.7% of a worker’s salary in the second quarter of 2023.

Monday, September 18, 2023

Thursday, September 14, 2023

Topics for September 16th Your Safe Money Show

Here's what we're working on for this Saturday's (September 16th) Your Safe Money Show. Todd has a recent money survey revealing more Americans are stressed about their finances. He’ll have the benefits of estate planning. Should you rent or own in retirement? And along those same lines, should you pay off your mortgage before you retire? Listen at 8 a.m. at Nice 95.5FM KBEK. They stream live at kbek.com. Hear recent shows by going to yoursafemoneyshow.com.

Tuesday, September 12, 2023

Recent scams

There have been 4 scams that are front and center this summer, concert and event ticket scams, vacation lodging scams, apartment rental scams, and student loan forgiveness scams. A consumer fraud expert has these tips to keep in mind: Keep your personal information to yourself. Do not share confidential information like your address, Social Security or credit card numbers unless you are certain the website or app is legitimate. Avoid clicking on unverified links. Some bad actors may use the name of legitimate businesses, but then take you to a website that has nothing to do with that business. Verify before entering any personal information that the site is legitimate. Watch for AI/deep fake imitations. Fraudsters may use AI to create deep fakes, whereby reputable public figures seemingly endorse a company’s products or services on social media. While you may be swayed into thinking it’s a legitimate endorsement, “the reality is that’s not the case,”. Do your due diligence on vendors. Sources like the Better Business Bureau and the Federal Trade Commission can provide background information on businesses, including whether there are consumer complaints against them. Set up real-time purchase alerts. By monitoring your accounts on a real-time basis, you can more quickly find any potential fraudulent compromises. Remember if something happens your credit card offers more protections than a debit card. Alert your financial institution if you see suspicious activity. While consumers may think of big-time purchases when it comes to fraud, often it starts with much smaller transactions of as little as $1. By alerting your credit card company or other financial institution about even small unknown transactions, you can potentially save yourself further trouble. yoursafemoneyshow.com.

Monday, September 11, 2023

Thursday, September 7, 2023

Your Safe Money Show content for 9-9-23

Coming up on our September 9th Your Safe Money Show. Todd will share things you should know about life insurance. He’ll also have practical ways seniors can cut expenses and what’s the difference between a pension plan and a 401(k)? Listen at 8 a.m. at Nice 95.5FM KBEK. They stream live at kbek.com. hear recent shows at yoursafemoneyshow.com.

Wednesday, September 6, 2023

Credit Card Competition Act

There’s a possible vote coming up by the end of the year about the Credit Card Competition Act . We’ll see if it passes BUT what is it and how does it affect consumers? The CCC Act is a bipartisan bill. It takes aim at the following: Merchant fees: Any merchant who accepts credit cards has to pay a fee to the credit card network every time customers swipe. These fees cost merchants $126.35 billion in 2022. Of course, accepting credit cards is…pretty much mandatory in 2023, which leaves merchants at the mercy of the credit card companies. Credit card processing networks: Visa and Mastercard control more than 80% of the credit card processing network market. As a duopoly, the two companies can pretty much charge whatever kind of fees they’d like. The CCC Act would change things up, forcing the financial institutions to enable at least two processing networks for their cards—and one of those networks must fall outside of the Visa/Mastercard duopoly. More processing networks for credit cards means more competition among the major credit card networks, which hopefully means lower fees for merchants. The American Bankers Association “strongly opposes” the bill, calling it a “regressive bill that takes from consumers, community financial institutions, and small businesses and gives to the most profitable global retailers and biggest grocery chains. Opponents also cite the Durbin Amendment, which limited how much issuers could charge merchants on debit card transactions as part of the 2010 Dodd–Frank Act. There’s concerns that credit card rewards would be affected too. But others say credit card companies will still offer rewards to gain new customers. Legislators won’t officially vote on the CCC Act until later this year at the earliest. In the meantime, it’s worth digging into the current nature of the credit card processing market to see why some senators think this move is a good idea. yoursafemoneyshow.com.