Monday, December 28, 2015

Highlights for Saturday January 2 Your Safe Money Show

On this week's Your Safe Money Show we look at a story of a wealthy real estate mogul who when he died left very specific instructions on when and how his 21 and 17 year old daughters would get their inheritance. Controlling from the grave how important is this? Also if you are getting married after divorce or a loved ones passing, there are things you need to be aware of in regards to retirement.

Thursday, December 24, 2015

Highlights for Saturday December 26 Your Safe Money Show

On Your Safe Money Show this Saturday we will look at the oil glut and how that has affected the prices at the pump and the Fed raising the interest rate what does that mean for our bottom lines. Plus a survey of over 2000 older Americans discovered ways to live without regrets. This is a show you won't want to miss, but if you do listen at the website next week at the podcast page.

Wednesday, December 23, 2015

Merry Christmas and Happy New Year

Everyone at Sjoberg & Holmstrom Financial Services and Your Safe Money Show, wishes you and your family a Merry Christmas and Happy New Year.

We are so thankful for our clients (and soon to be clients) and look forward to assisting you in 2016. The office will be closed December 24 through January 3. We will reopen Monday January 4. If you need assistance leave a message we will be monitoring messages and will get back to you.

We are so thankful for our clients (and soon to be clients) and look forward to assisting you in 2016. The office will be closed December 24 through January 3. We will reopen Monday January 4. If you need assistance leave a message we will be monitoring messages and will get back to you.

The Best Cloud Storage Services

Many people are using Cloud Storage for their important documents. Here's comparisons of some of those services.

The best cloud storage services

The best cloud storage services

Monday, December 21, 2015

Thursday, December 17, 2015

Highlight's for Saturday December 19 Your Safe Money Show

Do you feel retirement is a specific date or a dollar figure? On Saturday's Your Safe Money Show we'll explore that, along with exactly where does your paycheck come from in retirement? And Facebook recently had it's top 10 topics shared in 2015 and it gives a pretty accurate picture of what we feel was note worthy in 2015.

What the Federal Reserve interest rate increase means for you

Like most things in life the Fed's interest rate hike has good and bad implications, depending on you and your situation.

What the Federal Reserve interest rate increase means for you

What the Federal Reserve interest rate increase means for you

Wednesday, December 16, 2015

Tuesday, December 15, 2015

Monday, December 14, 2015

Yet another scam to be wary of

In this scam you get a call from a delivery company with a package on the way. They show up and say they need your credit or debit card for a nominal fee and there's wine in the gift basket and they need proof you're 18 or older. They scan your card and the scam is done.

Read the article for more details.

Ding-dong: The delivery scam that's coming to your front door

Read the article for more details.

Ding-dong: The delivery scam that's coming to your front door

Thursday, December 10, 2015

Highlights for Saturday December 12 Your Safe Money Show

What's your money personality? Are you a shopper, saver, investor, debtor, or spender? Find out on on this Saturday's Your Safe Money Show. Plus we'll discuss what to do with an inherited IRA or 401(k). There are very specific things to do so there won't be tax consequences.

Wednesday, December 9, 2015

Tuesday, December 8, 2015

Monday, December 7, 2015

Thursday, December 3, 2015

Highlight's for Saturday December 5 Your Safe Money show

How long have you had your refrigerator, washer, dryer, oven, furnace? Well everything has a shelf life and when you have to replace a bigger ticket item can hurt your budget if you haven't planned for it. We'll discuss how long these types of appliances ect. are suppose to last on this Saturday's Your Safe Money Show. Plus how does a 401(k) work after you retire?

Wednesday, December 2, 2015

Tuesday, December 1, 2015

Monday, November 30, 2015

Wednesday, November 25, 2015

Highlight's for Saturday November 28 Your Safe Money Show

Medicare and individual health insurance open enrollment is going on now. On this Saturday's Your Safe Money Show I have questions to ask when looking into insurance.Also,as we near the end of the year there are certain financial steps you might want to consider taking to save you money in the long run. And being charitable is a wonderful thing but be cautious. Not all charities are on the up and up

Thursday, November 19, 2015

Highlights for Saturday November 21 Your Safe Money Show

FAFSA stands for Free Application for Federal Student Aid and is used by most when trying to get help for college tuition ect. Well there's a few big changes happening with the system and I will share those changes and how to manage them on this Saturday's Your Safe Money Show. After divorce or the loss of a spouse over half previously married get remarried. There can be financial concerns that I want you to be aware of. And The Brookings Retirement Security Project happened recently and I'll have results from that.

Wednesday, November 18, 2015

Why ‘affordable’ healthcare is leaving some families with sticker shock

I am a licensed MnSure broker in Minnesota. There are 21 of us around the state. If you need help with plan options and enrollment, call 877-812-0259. You can find a broker near you by going to www.mnsure.org/help/find-assister.

Why ‘affordable’ healthcare is leaving some families with sticker shock

Why ‘affordable’ healthcare is leaving some families with sticker shock

Tuesday, November 17, 2015

Tuesday, November 10, 2015

Monday, November 9, 2015

Thursday, November 5, 2015

Highlights for Saturday November 7 Your Safe Money Show

On this Saturday's Your Safe Money Show, the BiPartisan Budget Act of 2015 which President Obama signed into law this week makes changes to the Social Security system that affects married couples, and in some cases, an ex-spouse. I'll be sharing those changes AND have you heard of "High-Tech Granny Pods"? Well they might be a viable option for senior housing.

Tuesday, November 3, 2015

Mn Sure Open Enrollment

If you live in Minnesota and If you have questions about health insurance coverage options, how to complete the MNsure application, or how to choose the best plan for you, stop by our office for no cost in-person assistance from licensed insurance brokers who are certified through MNsure. Events at local libraries are also being offered at no cost. Go to the website yoursafemoneyshow.com for locations and call for an appointment 320-679-5183. You can also go to mnsureevents.org.

Monday, November 2, 2015

Credit Card Users Suffer Fatigue From the Rewards Game

Be aware of the pro's and con's with these rewards cards.

Credit Card Users Suffer Fatigue From the Rewards Game

Credit Card Users Suffer Fatigue From the Rewards Game

Thursday, October 29, 2015

Highlights for Saturday October 31 Your Safe Money Show

Do you have a 401(k) at your work? Do you understand all the in's and out's? How about the new contribution limits for 2016? Or maybe you do not have a 401(k) at your work, what's the best way for you to save for retirement? Check in this Saturday on Your Safe Money Show and I'll have the Good the Bad and the Ugly of 401(k)'s.

Tuesday, October 27, 2015

U.S. Plans to Sell Down Strategic Oil Reserve to Raise Cash

Did you know that the U.S. has 695 million barrels of crude oil in reserve? How much are they selling? Read on.

U.S. Plans to Sell Down Strategic Oil Reserve to Raise Cash

U.S. Plans to Sell Down Strategic Oil Reserve to Raise Cash

Monday, October 26, 2015

Thursday, October 22, 2015

Highlights for Saturday October 24 Your Safe Money Show

Coming up on this Saturday's Your Safe Money Show, Medicare Open Enrollment started October 15th and runs until December 7th. I'll go over the importance of reviewing your coverage at this time. Also be aware that open enrollment for MNSure (individual and family health insurance for those under 65 years of age in the state of Minnesota) starts November 1st and goes until January 31st. I will also look at outdated retirement decisions and get you "up to date" on those decisions.

Wednesday, October 21, 2015

How to Save on Halloween Candy, Costumes and Spooky Decor

Here's some ideas to make Halloween more affordable.

How to Save on Halloween Candy, Costumes and Spooky Decor

How to Save on Halloween Candy, Costumes and Spooky Decor

Tuesday, October 20, 2015

Don't fall for this chip credit card scam

Here's a good reminder about scammers and the new chip credit cards.

Don't fall for this chip credit card scam

Don't fall for this chip credit card scam

Monday, October 19, 2015

Thursday, October 15, 2015

Highlights for October 17 Your Safe Money Show

I hope you can feel my excitement as this third week in October is National Save for Retirement week!!!! I'll have ways for you to get on board with this recognition, on this week's Your Safe Money Show. Plus seniors and those getting Social Security had news this week on their annual COLA (cost of living adjustment).

Wednesday, October 14, 2015

Tuesday, October 13, 2015

4 Health Benefit Changes to Expect in 2016

Now more so than ever before you need to be your own advocate when it comes to healthcare benefits. Costs are rising for most in 2016 and this article gives some good ideas how to protect yourself by reviewing and following up on plan options and your bills too.If you need help Sjoberg & Holmstrom is a broker enrollment center for MnSure and health insurance carriers.

4 Health Benefit Changes to Expect in 2016

4 Health Benefit Changes to Expect in 2016

Thursday, October 8, 2015

Highlights for Saturday October 10 Your Safe Money Show

On this Saturday's (10-10-15) Your Safe Money Show we look at health insurance rates rising and what that means for you and your family. Plus joint replacement (knee and hip) has become much more common. Were living longer and want quality of life and joint replacement can be part of that.

Wednesday, October 7, 2015

Childcare now costs more than rent. No wonder more women are opting out of the workforce

The cost of childcare has gone up and families have to look at what that cost is compared to income generated by their job. By the time you pay childcare and other costs associated with a job, car and fuel costs, clothing allowance, you hope you are staying ahead. This article mentions "women" opting out of the workforce but I feel the decision for one parent to "stay home" would depend on the family and their income situation.

Childcare now costs more than rent. No wonder more women are opting out of the workforce

Childcare now costs more than rent. No wonder more women are opting out of the workforce

Tuesday, October 6, 2015

Monday, October 5, 2015

Thursday, October 1, 2015

Highlights for Saturday October 3 Your Safe Money Show

Have you received your new EMV chip credit card? Well changes are on the way and we'll talk about what that means for you on this Saturday's Your Safe Money Show. Also there are some fees on credit cards many people aren't aware of, find out what they are and how to avoid them.

Wednesday, September 30, 2015

Tuesday, September 29, 2015

Monday, September 28, 2015

Thursday, September 24, 2015

Highlights for Saturday September 26 Your Safe Money Show

Well "The Fed" decided not to raise interest rates, for the time being. I think it will still happen even this year and what will that mean to all of our pocket books? I'll go into detail on that and look at another scam you need to be aware of if you plan on traveling yet this fall. I hope you can tune in Saturday September 26 for Your Safe Money Show

Wednesday, September 23, 2015

Tuesday, September 22, 2015

Monday, September 21, 2015

Thursday, September 17, 2015

Highlights for September 19 Your Safe Money Show

The first day of Autumn is Wednesday the 23rd, hard to believe. If you've put off reviewing your budget, this is a great time to give it the once over. I'll have suggestions on how to get your budget on track before winter. Starting Oct. 1st, 100,000 medical codes will start to be used at medical facilities all over the country. What will this mean for you as a patient?

Wednesday, September 16, 2015

Typical American family earned $53,657 last year

Cost of living varies from state to state and is not mentioned in this story. Still interesting.

Typical American family earned $53,657 last year

Typical American family earned $53,657 last year

Tuesday, September 15, 2015

Monday, September 14, 2015

Gas Price Drops 27 Cents in Past 3 Weeks

Talk to anyone these days and they'll tell you lower gas prices have really helped their "bottom line".

Gas Price Drops 27 Cents in Past 3 Weeks

Gas Price Drops 27 Cents in Past 3 Weeks

Thursday, September 10, 2015

Highlights of Saturday September 12 Your Safe Money Show

Retiring early, for many people it's not a choice, they can't keep working. On this Saturday's Your Safe Money Show we talk about the ramifications of early retirement. We also answer a question about closing or canceling a credit card, does it hurt or help your credit score?

Wednesday, September 9, 2015

9 Pricing Secrets Grocery Stores Don't Want You to Know

Here's some great tips that can save you money.

9 Pricing Secrets Grocery Stores Don't Want You to Know

9 Pricing Secrets Grocery Stores Don't Want You to Know

Thursday, September 3, 2015

Highlights for Saturday September 5 Your Safe Money Show

Have you ever been asked to "co-sign" on a loan for someone? It's not something to take lightly. This Saturday on Your Safe Money Show I'll have some tips on how to handle co-signing if you decide to do so. Also what's the "shelf life" for some common household items? I'll share how long to keep them and why.

Wednesday, September 2, 2015

Tuesday, September 1, 2015

Thursday, August 27, 2015

Highlights for Saturday August 29 Your Safe MoneyShow

On this week's Your Safe Money Show I will get into diversification, asset allocation, volatility in the markets and safe money strategies.

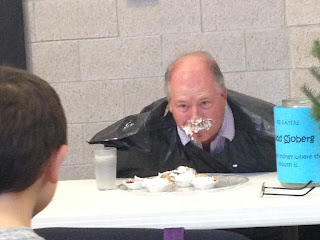

Check out the pie eating contest

I know this is Todd's Blog but I had to share pics from a recent pie eating contest at Todd's church in Mora.

Tuesday, August 25, 2015

Asia's richest man lost $13 billion in China crash

Asia's richest man lost $13 billion in China crash

http://money.cnn.com/2015/08/25/investing/wanda-wang-jianlin-wealth-loss/index.html?iid=hp-stack-dom

http://money.cnn.com/2015/08/25/investing/wanda-wang-jianlin-wealth-loss/index.html?iid=hp-stack-dom

Monday, August 24, 2015

How low the stock market can go

I am a "Safe Money" advocate and I am concerned about what's happening in the markets recently.

How low the stock market can go

How low the stock market can go

Thursday, August 20, 2015

Highlights for Saturday August 22 Your Safe Money Show

We've all heard about the "middle class" but on this week's Your Safe Money Show we go into what that term really means and you can decide if you are "middle class". Budgeting with your significant other can be a challenge and I'll share some insight in how to do this so you get better results. And withdrawing from retirement accounts too early can cost you but there are exceptions as well.

Wednesday, August 19, 2015

Tuesday, August 18, 2015

Monday, August 17, 2015

Drivers Outraged as Gas Prices Soar While Oil Prices Plummet

Everybody was talking how gas prices jumped at least 30 cents around Central Minnesota in a day last week, well here's what some are saying caused the jump. See for yourself.

Drivers Outraged as Gas Prices Soar While Oil Prices Plummet

Drivers Outraged as Gas Prices Soar While Oil Prices Plummet

Thursday, August 13, 2015

Highlights for Saturday August 15 Your Safe Money Show

On this week's Your Safe Money Show we look at a story of a wealthy real estate mogul who when he died left very specific instructions on when and how his 21 and 17 year old daughters would get their inheritance. Controlling from the grave how important is this? Also if you are getting married after divorce or a loved ones passing, there are things you need to be aware of in regards to retirement.

Wednesday, August 12, 2015

Thursday, August 6, 2015

Highlights for Saturday August 8 Your Safe Money Show

Getting our children back to school or off to college can hit us in the "budget" hard. On this Saturday's Your Safe Money Show we talk about these costs and compare to past year's and what we can do to help handle these costs. Plus there's a record number Baby Boomers hitting the open road in RV's, we'll see if this is something you might want to try.

Thursday, July 30, 2015

Highlights for Saturday August 1 Your Safe Money Show

So do you understand the difference between an HSA, health savings account and an FSA, flexible spending account? On this Saturday's Your Safe Money Show we'll go over these accounts and the in's and out's. Medicare turned 50 years old on July 30th so I thought we'd go over all the "Parts" and requirements.

Tuesday, July 28, 2015

Low-Cost Home Security Options to Keep Out Thieves

Here's some great ways to keep your home safe for not a lot of money.

Low-Cost Home Security Options to Keep Out Thieves

Low-Cost Home Security Options to Keep Out Thieves

Monday, July 27, 2015

State health insurance markets struggle with cost challenges

See how Minnesota is doing compared to other states.

State health insurance markets struggle with cost challenges

State health insurance markets struggle with cost challenges

Thursday, July 23, 2015

Highlights for Saturday July 25 Your Safe Money Show

Generation Xers in the past have gotten a somewhat bad rap. On this Saturday's Your Safe Money Show we talk about that and their current financial situation. Plus I'll have you do a 3 question test of basic money smarts to see how you do.

Wednesday, July 22, 2015

Tuesday, July 21, 2015

How Reading Your Social Security Statement Can Make You Richer

Here's some great information on reading your Social Security statement.

If you would like "Your Guide to Social Security" a free booklet just message me here and we'll mail it or send it in an email to you.

How Reading Your Social Security Statement Can Make You Richer

If you would like "Your Guide to Social Security" a free booklet just message me here and we'll mail it or send it in an email to you.

How Reading Your Social Security Statement Can Make You Richer

Monday, July 20, 2015

Thursday, July 16, 2015

Highlights for this Saturday July 18 Your Safe Money Show

Earlier this week the White House Conference on Aging went on and I'll share some of what came out of that conference and how it will effect older Americans. Also Social Security by the numbers, how much difference does it make getting your benefits at age 62 to 70.

Wednesday, July 15, 2015

Here’s How Much You’ll Spend on School Supplies This Year

I know it seems way to early to talk about back to school but the stores have had supplies out since the 4th of July. Keep in mind this is a national story and many schools start in August in some parts of the country.

Here’s How Much You’ll Spend on School Supplies This Year

Here’s How Much You’ll Spend on School Supplies This Year

Tuesday, July 14, 2015

Monday, July 13, 2015

Greece crisis reaches deal with creditors

On last Saturday's Your Safe Money Show we talked about the crisis in Greece and how it affects everyday Americans. Well we learned today (Monday) that a preliminary budget deal has been reached but more needs to be done.

Greece reaches deal with creditors, avoids euro exit

Greece reaches deal with creditors, avoids euro exit

Thursday, July 9, 2015

Highlight's for Saturday July 11 Your Safe Money Show

The crisis in Greece is effecting markets around the world but there's also other implications, we'll look at those on this Saturday's Your Safe Money Show. Plus protecting your credit card information is so important, and I have advice from an attorney that is invaluable should your information be lost or stolen.

3 reasons the average American may be worse off than Greece

On this Saturday's Your Safe Money Show, we'll look at the crisis in Greece and see how it affects everyday American's.

3 reasons the average American may be worse off than Greece

3 reasons the average American may be worse off than Greece

Wednesday, July 8, 2015

Tuesday, July 7, 2015

10 Signs You Might Be a Victim of Identity Theft

Nothing can throw your life into more turmoil than having your identity stolen. So when I see articles that offer tips to keep your identity safe, I feel compelled to share them with you.

10 Signs You Might Be a Victim of Identity Theft

10 Signs You Might Be a Victim of Identity Theft

Thursday, July 2, 2015

Highlights for this Saturday July 4th Your Safe Money Show

On this week's Your Safe Money Show we continue our discussion from last week with Dennis Norby on insurance, with this week's focus on home/farm and commercial coverage. Plus I will share what I learned at a recent class on health insurance and Medicare.

Hours for Sjoberg & Holmstrom

With the 4th of July falling on a Saturday this year, we will be closed Friday July 3rd and reopen Monday at 8 am. Have a wonderful 4th and we will be monitoring messages so if you have a concern call 320-679-5183 and we'll get back to you as soon as possible.

Wednesday, July 1, 2015

My son Ryan and his battaloin

Here's pictures of my son Ryan and his battalion at the USS Arizona Memorial in Hawaii. So proud of my son and all who serve our country today and have in the past, with many giving the ultimate sacrifice. Remember them all this 4th of July!

Best Part-time Jobs for Retiree's

Sometimes retirees after a while find themselves wanting more to do. Why not use your talents and experience in a part-time job? Some retirees might need the extra cash but for others it's the satisfaction of contributing their skills to others.

Now is a great time for retirees looking for part-time work as employers like hiring someone with experience and many don't need health benefits since most have Medicare.

So what jobs seem to work best?

Read the article below to see what might work well for you.

http://finance.yahoo.com/news/6-best-part-time-jobs-100158058.html

Now is a great time for retirees looking for part-time work as employers like hiring someone with experience and many don't need health benefits since most have Medicare.

So what jobs seem to work best?

Read the article below to see what might work well for you.

http://finance.yahoo.com/news/6-best-part-time-jobs-100158058.html

Monday, June 29, 2015

Thursday, June 25, 2015

Highlight's for Saturday June 27 Your Safe Money Show

Insurance is a major part of most people's budget, so any way we can save on those premiums is a good thing. On this Saturday's Your Safe Money Show we talk with Dennis Norby our auto/home/ and commercial coverage guy here at Sjoberg & Holmstrom. He is an independent agent and can shop the best coverage for you.

Wednesday, June 24, 2015

10 Simple Ways to Raise Your Credit Score

Your credit score determines how much you'll pay for insurance, mortgage, and more so keeping your score high is a real money saver.

10 Simple Ways to Raise Your Credit Score

10 Simple Ways to Raise Your Credit Score

Tuesday, June 23, 2015

Monday, June 22, 2015

Readers Choice Winner!

Sjoberg & Holmstrom Financial services was voted Best Financial Advisor Firm 2015 Readers' Choice winner in the Scotsman for Pine/Kanabec. Thank you to the readers and the Scotsman for this recognition!

Thursday, June 11, 2015

Highlights for this Saturday June 13 Your Safe Money Show

Gen X-ers (age 35 to 50 this year) are facing a tough financial road, I'll get specific on this topic on this Saturday's Your Safe Money Show. Also your golden years shouldn't be spent worrying if you can pay your mortgage each month, but some retirees do just that. I'll have ways to reduce housing costs.

Wednesday, June 10, 2015

6 Lessons That Turn Kids Into Money-Savvy Adults

Here's some great ideas to help your children understand the value of money and how to manage it. Some adults might like this too

6 Lessons That Turn Kids Into Money-Savvy Adults

6 Lessons That Turn Kids Into Money-Savvy Adults

Thursday, June 4, 2015

Highlights for Saturday June 6 Your Safe Money Show

If you are counting on an inheritance to help supplement your retirement, you might want to rethink that. Life doesn't always turn out the way you want. That's one of the things I'll be talking about on this Saturday's Your Safe Money Show. Plus there are getting to be more "elder orphans", people who end up alone late in life and what can be done to help these folks out? And if you have ever had an overdraft you are not alone. What can be done to minimize that from happening?

This is the best time to quit paying for TV, and it’s only going to get better

How we get and watch our favorite shows is changing.

This is the best time to quit paying for TV, and it’s only going to get better

This is the best time to quit paying for TV, and it’s only going to get better

Wednesday, June 3, 2015

Tuesday, June 2, 2015

Thursday, May 28, 2015

Dinner Events a success

I wanted to thank everyone who came out for our Dinner Events at Michael's in St. Cloud. I enjoyed meeting everyone and sharing information on retirement concerns, from Social Security to Medicare and more. I'll be doing more of these events down the road and we'll remind you about them here at my blog, at the website and on the radio show.

If you're looking for a great place to hold a banquet or want a night out with delicious food Michael's is the place to be. Here's the link to see their website.

Michael's restaurant

If you're looking for a great place to hold a banquet or want a night out with delicious food Michael's is the place to be. Here's the link to see their website.

Michael's restaurant

Thursday, May 21, 2015

Sjoberg & Holmstrom Financial Services Closed on Monday

We will be closed on Monday Memorial Day. If you need assistance leave a message at 320-679-5183, we will be monitoring messages.

Have a safe and enjoyable holiday weekend and remember our veterans past and present.

Have a safe and enjoyable holiday weekend and remember our veterans past and present.

Highlights for this Saturday May 23 Your Safe Money Show

What is your "Net Worth"? By understanding that number and making comparisons to others in your age group you can gain insight to make changes if need be. The Supreme Court made a ruling this week to make it easier to sue your 401(k). What does that mean to you? And we had a question about the advantage of a Roth IRA over a traditional IRA.

Tuesday, May 19, 2015

Monday, May 18, 2015

Thursday, May 14, 2015

Highlights for Saturday May 16 Your Safe Money Show

Will the Fed decide to raise interest rates and if so what will that mean to you and me? Find out on this Saturday's Your Safe Money Show. Also volatility with the stock market can wreak havoc when you're trying to save for retirement, what options do you have? And will the next batch of candidates for President take on the hard job of "reforming" Social Security and Medicare, we'll see. Find out what the Simpson-Bowles Commission report proposes.

Verizon, Sprint to Pay Millions to Settle 'Cramming' Suits

Be sure to check your monthly statements for errors.

Verizon, Sprint to Pay Millions to Settle 'Cramming' Suits

Verizon, Sprint to Pay Millions to Settle 'Cramming' Suits

Wednesday, May 13, 2015

Tuesday, May 12, 2015

Monday, May 11, 2015

3 Things You Really Should Know About Mobile Payments

Is this the future of paying bills? See for yourself.

3 Things You Really Should Know About Mobile Payments

3 Things You Really Should Know About Mobile Payments

Thursday, May 7, 2015

Highlights for Saturday May 9 Your Safe Money Show

Everyone makes mistakes sometime, but when it comes to your retirement, that can be a disaster. On this week's Your Safe Money Show I'll have ways to avoid or at the very least fix retirement mistakes.

Wednesday, May 6, 2015

Tuesday, May 5, 2015

Monday, May 4, 2015

Thursday, April 30, 2015

Highlights for Saturday May 2 Your Safe Money Show

More than 4500 people enroll in Medicare daily. So I thought I better talk about some changes to Medicare including the number on your card changing and a new law fixes how doctors are paid. Plus I'll have four mistakes for you to avoid when enrolling in Medicare. We're also having a complementary dinner event and for more details check the website.

Wednesday, April 29, 2015

These 22 cars are the most economical to own

Here's an interesting take on how car prices are more than the sticker price.

These 22 cars are the most economical to own

These 22 cars are the most economical to own

Tuesday, April 28, 2015

Thursday, April 23, 2015

Highlights for this Saturday April 25 Your Safe Money Show

April is Financial Literacy Month, so before the month is done I'll talk about mandated financial programs in High School, do they make a difference? As more and more boomers get into retirement, housing needs change, we'll look at the current trends for retirees .

3 Money Questions Every Couple Must Answer Before They Marry

If you are getting married this year, read this article first.

Money questions every couple must answer before they marry

Money questions every couple must answer before they marry

Wednesday, April 22, 2015

Tuesday, April 21, 2015

Monday, April 20, 2015

Thursday, April 16, 2015

Highlights of Saturday April 18 Your Safe Money Show

On this week's Your Safe Money Show author Dan Buettner has a book out called "The Blue Zones Solution: Eating and Living Like the World's Healthiest People", we will share ideas from his book on living a long and healthy life.

Did you know if student loan debt isn't paid by the time you draw Social Security the government can take money from your Social Security? They can, and I'll have ways to keep this from happening.

I will also have things you can do now to help you with next years taxes.

Did you know if student loan debt isn't paid by the time you draw Social Security the government can take money from your Social Security? They can, and I'll have ways to keep this from happening.

I will also have things you can do now to help you with next years taxes.

Wednesday, April 15, 2015

Tuesday, April 14, 2015

7 Valuable Childhood Collections That You Could Sell

Do you have something from your childhood that's worth some money?

Valuable childhood collections that you could sell

Valuable childhood collections that you could sell

Monday, April 13, 2015

Thursday, April 9, 2015

Highlights for Saturday April 11 Your Safe Money Show

Will you be able to maintain your standard of living in retirement? A recent finding says Americans standard of living is dropping in retirement and another says were not saving enough. This will not be a gloom and doom show, I have solutions to these concerns. I also look at renters insurance, is it a good idea?

Buried under student loan debt? Help is on the way

Being strapped with student loan debt can make it difficult to make ends meet long after graduation. Looks like there's help.

Student loan debt? help is on the way

Student loan debt? help is on the way

Wednesday, April 8, 2015

When Seasonal Allergies Get Serious

Why would I post this article on a Safe Money site? Well allergies are an issue for so many and when someone's allergies are at their worst, you can miss work and that means loss of income. So I hope this information helps you id you're an allergy sufferer.

Seasonal allergies

Seasonal allergies

Tuesday, April 7, 2015

Monday, April 6, 2015

Thursday, April 2, 2015

Closed for Good Friday

A reminder Sjoberg & Holmstrom Financial Services will be closed Friday April 3 for Good Friday. Everyone at Sjoberg & Homstrom Financial Services and Your Safe Money Show wish you and your family a joyous Easter!

Highlights for Saturday April 4 Your Safe Money Show

Do you wonder how long to keep documents, like bank statements, tax returns, certificates, and other papers? We tell you what to save , for how long and what you can throw or shred. Also, I think all of us at one time or another, have received "bad money advice". I'll tell you why some of the more common money misconceptions should be looked at.

Wednesday, April 1, 2015

Tuesday, March 31, 2015

Monday, March 30, 2015

Thursday, March 26, 2015

Highlights for Saturday March 28 Your Safe Money Show

We all love paying taxes right? Oh guess not...well on this Saturday's Your Safe Money Show I share tax saving ideas and have a reminder about the Homestead Credit Refund and Renter's Rebate.

Wednesday, March 25, 2015

Tuesday, March 24, 2015

How Retirement Benefits Will Change in 2015

New retirement benefit features for this year...see what you think.

How retirement benefits have changed for 2015

How retirement benefits have changed for 2015

Monday, March 23, 2015

Thursday, March 19, 2015

Highlights for Saturday March 21 Your Safe Money Show

Tax time is right around the corner, filing late means penalties. On this week's Your Safe Money Show I'll tell you how expensive those penalties can be.

The U.S. government has run into the legal limit on how much it can borrow, find out how that affects you.

And the year you're going to retire, I have a to-do list that will help you plan your retirement.

The U.S. government has run into the legal limit on how much it can borrow, find out how that affects you.

And the year you're going to retire, I have a to-do list that will help you plan your retirement.

What an interest rate increase means for real people

This article ties into one of the topics on this week's Your Safe Money Show, and that is how inflation can impact your ability to save or borrow.

What an interest increase means for real people

What an interest increase means for real people

Wednesday, March 18, 2015

Audit Red Flags: How to Avoid an IRS Examination

With tax time right around the corner here's some good suggestions to help avoid an audit.

How to try to avoid an IRS audit

How to try to avoid an IRS audit

Tuesday, March 17, 2015

Thursday, March 12, 2015

Highlights for Saturday March 14 Your Safe Money Show

Are you helping to financially support your adult children? That can really hurt your ability to save for your retirement. Find out how to get yourself out of this situation. The three biggest credit reporting agencies say they will change the way they handle errors, we'll talk about how that affects you. Tune in for Your Safe Money Show Saturday morning March 14th.

Wednesday, March 11, 2015

Tuesday, March 10, 2015

Thursday, March 5, 2015

Highlights for Saturday March 7 Your Safe Money Show

We look at whether you should "replace" or "repair" big ticket items in your home. Roof, furnace, air-conditioner, plumbing and appliances and we find out how long approximately these items should last.

And when is the best time to convert an IRA to a Roth IRA?

And when is the best time to convert an IRA to a Roth IRA?

Wednesday, March 4, 2015

Tuesday, March 3, 2015

Monday, March 2, 2015

Roth IRA questions answered

Here's some questions about Roth IRA's answered from a market watch article.

Roth IRA questions answered

Roth IRA questions answered

Thursday, February 26, 2015

Highlights for Saturday February 28 Your Safe Money Show

Finances can be a challenge at any age, once you're out in the work-a-day world. On this Saturday February 28th Your Safe Money Show, I'll look at the unique financial challenges we have during mid-life and how we can over come some of those challenges. Plus, empty nesters have an opportunity to save some money for retirement once the children are on their own.

Wednesday, February 25, 2015

NerdWallet Survey Results

The average U.S. adult scores about 50% on personal finance questions related to U.S. federal income tax returns. Most American adults get an “F” in understanding income tax basics, according to a NerdWallet survey. Respondents scored on average 51% in a 10-question quiz on tax basics related to such personal finance issues as retirement, college savings and health care.

Tuesday, February 24, 2015

Thursday, February 19, 2015

Highlight's for Saturday February 21 Your Safe Money Show

I think we all know the cost of healthcare is s huge concern, especially as we look to retirement. On this week's Your Safe Money Show we examine ways to save money on healthcare and prescriptions.

Wednesday, February 18, 2015

Tuesday, February 17, 2015

Thursday, February 12, 2015

Highlights for February 14 Your Safe Money Show

So Valentine's Day is this Saturday and Your Safe Money Show looks at on-line dating coaches and what they can do to help you find that special someone. We'll also talk about the recent "Stress in America" survey that shows the number one worry weighing on people's health is money.

Wednesday, February 11, 2015

Want cheap airfare? This is the best day to book a plane ticket

Planning a trip and need a flight to get there? Check this out first.

When you buy ticket can make a difference

When you buy ticket can make a difference

Tuesday, February 10, 2015

Monday, February 9, 2015

Your Planning Guide

On last Saturday's show I gave Your Planning Guide away as a gift to listeners that wanted a nice all-in-one binder of papers you can fill in with your important info. for loved ones. If you're reading this and would like this guide simply go to the contact us page and ask for yours.

Thursday, February 5, 2015

Highlights for Saturday February 7 Your Safe Money Show

On this week's Your Safe Money Show we talk about a family who's Mother passed away unexpectedly and they had no idea where any of her documents were or what her wishes would be. I don't want this to happen to you and your family. Find out what documents to have and where to keep them and how to have "that" conversation with your loved one. Also when one spouse passes away sometimes the remaining one can have financial hardships. What can be done to make this situation better. Listen at the stations listed or go to the podcast page Monday to hear the show there.

Wednesday, February 4, 2015

Tuesday, February 3, 2015

Monday, February 2, 2015

Thursday, January 29, 2015

Highlights for this Saturday January 31st Your Safe Money Show

Could a "phased retirement" be right for you? I look into what a "phased retirement" is and how the government is implementing it this year and if it will work in the private sector. Tune into Your Safe Money Show this Saturday the 31st of January to get the scoop

How Long Can You Expect Your Roof or Fridge to Last?

Keeping enough money tucked away to cover the cost of replacing a big ticket item like a refrigerator is important. This article tells you what the average shelf life is for various items in your home.

How long will items in your home last?

How long will items in your home last?

Wednesday, January 28, 2015

Tuesday, January 27, 2015

WE’LL SPEND BIG ON VALENTINE’S DAY

Americans are feeling sweet about romance as Valentine’s Day approaches, with consumers expected to spend big this year on candy, jewelry and flowers. The average person celebrating the holiday on February 14 (a Saturday) expects to spend $142.31 in the name of love, about $8 more than last year.

Monday, January 26, 2015

Thursday, January 22, 2015

Highlights for Saturday January 24 Your Safe Money Show

Everyone makes mistakes sometime but when it comes to your retirement income you can't afford to make too many mistakes. On this week's Your Safe Money Show I discuss 7 common financial mistakes and how to avoid or minimize them.

Wednesday, January 21, 2015

Texas is preparing for an oil bust

Preparing for oil bust

This story out of Texas talks about having a backup plan. Today retirees and pre-retirees need to understand the importance of getting a "plan" together to make sure you'll have enough income to carry you all the way through retirement.

This story out of Texas talks about having a backup plan. Today retirees and pre-retirees need to understand the importance of getting a "plan" together to make sure you'll have enough income to carry you all the way through retirement.

Thursday, January 15, 2015

Highlights for this Saturday January 17 Your Safe Money Show

Because were living longer the opportunity to keep working in retirement is becoming more common. What I mean by work could be a second career, or something you've always wanted to do. On this week's Your Safe Money Show we look at what some soon to be retirees and retirees are doing to make their retirement more fulfilling.

Subscribe to:

Comments (Atom)